Georgism#

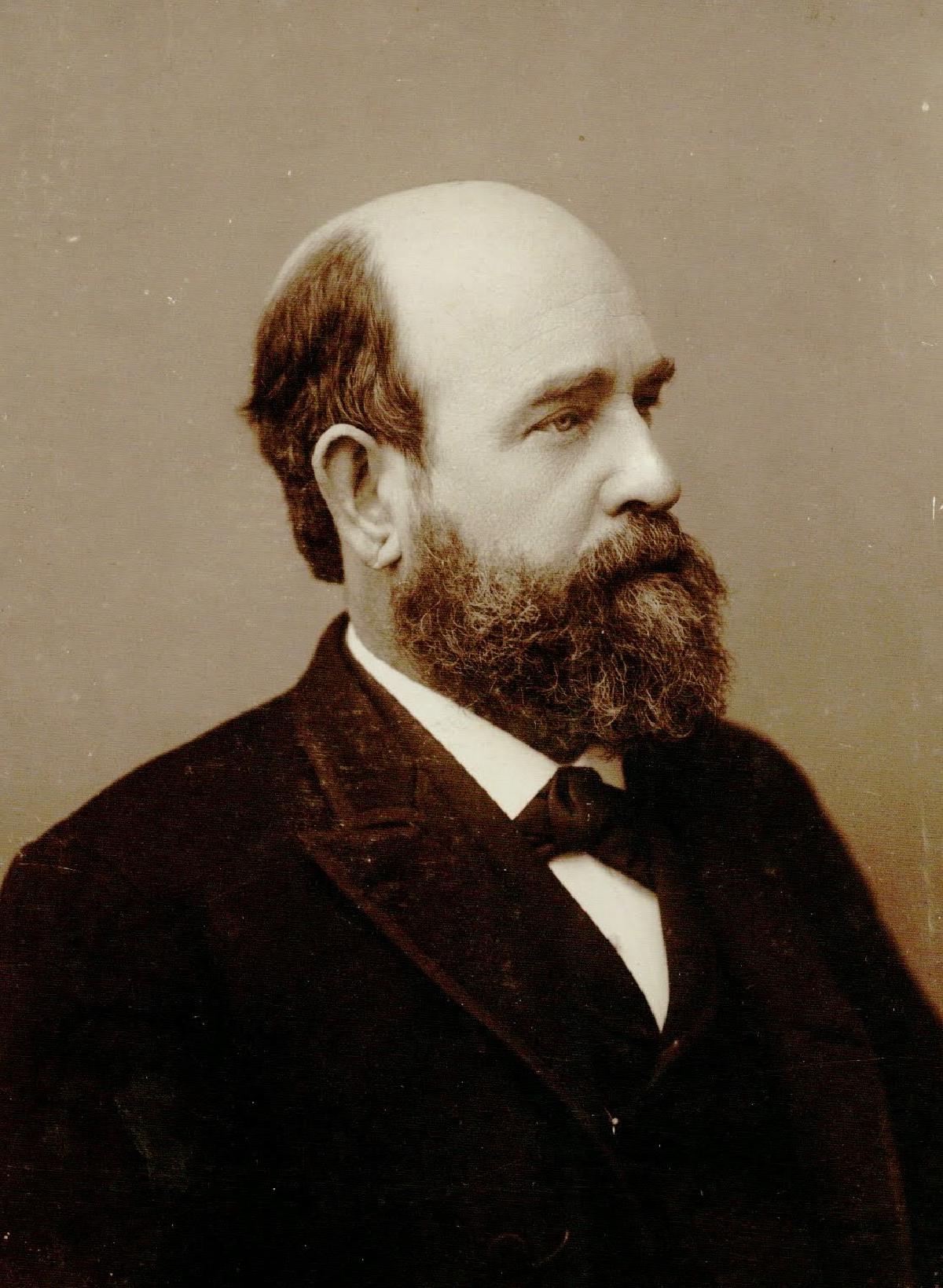

Georgism is an economic philosophy developed by Henry George in the late 19th century, centered around the idea that while individuals should own the value they create through their labor and capital, the economic rent derived from land and natural resources belongs equally to all members of society. This philosophy addresses the problem of economic inequality and inefficiency caused by private land ownership and rent-seeking behavior.

“This right of ownership that springs from labor excludes the possibility of any other right of ownership. If a man be rightfully entitled to the produce of his labor, then no one can be rightfully entitled to the ownership of anything which is not the produce of his labor, or the labor of some one else from whom the right has passed to him…When nonproducers can claim as rent a portion of the wealth created by producers, the right of the producers to the fruits of their labor is to that extent denied.”

- Henry George, Progress and Poverty (1879)

Core Concept: Land Value Tax (LVT)#

At the heart of Georgism is the Land Value Tax, a tax on the unimproved value of land, excluding the value of buildings or other improvements. Unlike traditional taxes on income or property improvements, the LVT targets the rental value of land itself, which is seen as a common resource that should benefit the public rather than private landlords. For example, an apartment building and a parking lot on the same land would be taxed equally based on the land’s value, encouraging owners to develop land productively rather than holding it for speculative gain.

Economic and Social Implications#

Georgism argues that taxing land value is both fair and efficient. It discourages speculation and underutilization of land, promotes development, and can replace other taxes that are considered unfair or economically harmful, such as income or sales taxes. By capturing the economic rent of land, Georgism aims to reduce inequality and increase economic opportunity, potentially enabling full employment by reducing the need for wage labor under exploitative conditions.

Philosophical and Historical Context#

Henry George’s ideas build on earlier thinkers like John Locke and Thomas Paine, emphasizing that natural resources are the common heritage of humanity. His book Progress and Poverty (1879) popularized these ideas, influencing political movements and economic thought in the late 19th and early 20th centuries. Although Georgism is less prominent today, many economists agree with its principles, and modern adaptations continue to explore how land value capture can be implemented fairly and effectively.

Modern Variations and Debates#

While the pure form of Georgism advocates replacing all other taxes with a land value tax, some modern proponents support partial capture of land rents or combining LVT with other policies like basic income or community land trusts. There are also debates about how much of the land rent should be taxed and how to balance compensation to landowners with social equity.

Real World Examples of Georgism#

There are several real-world examples of land value taxation (LVT) systems inspired by Georgist principles:

Denmark has had a land value tax called Grundskyld since 1902, making it one of the earliest adopters. The tax is levied on all land, including agricultural and government-owned land, with some exemptions. It remains an integral part of Denmark’s tax base today.

Estonia introduced a national land value tax in 1993 after regaining independence. It was designed to encourage productive use of land and provide stable tax revenue. The tax is administered nationally but revenues are distributed to local municipalities.

New Zealand implemented a land value tax in the early 20th century. Although the national land tax was abolished, local governments still have the option to levy property taxes based on unimproved land value.

Australia (Queensland) has a fully operational land value tax system at both state and local government levels. Local councils can apply differential rates based on land use, encouraging efficient land use and discouraging speculation.

Namibia introduced a land value tax on commercial farmland in 2004 as part of land reform efforts to address historical inequalities. The tax rate increases with the number of properties owned, discouraging large-scale landholding by a few.

United States (Altoona, Pennsylvania) is a notable example where the city relies entirely on a land value tax, having phased out taxes on buildings by 2011. The tax incentivizes development of vacant or underused land and supports a more stable local economy.

Other countries with some form of land value taxation include Kenya, Hungary, Mexico (Mexicali), and Russia, where LVT is used to varying degrees to promote equitable land use and generate public revenue.

While many countries apply land value taxation alongside other property taxes, these examples show that LVT can be implemented effectively at municipal, regional, or national levels to encourage productive land use and reduce speculation.

The Main Criticisms of Georgism#

The main criticisms of the land value tax (LVT), a core element of Georgism, center on practical, economic, and social challenges that have emerged both historically and in modern debates:

Administrative Complexity and Cost

Implementing LVT requires accurately assessing the unimproved value of land, which is often difficult and contentious. Valuations must consider location, potential land use, and market fluctuations, leading to disputes and legal challenges. Historical attempts, such as early 20th-century Britain, showed that administrative costs of valuation and collection could exceed the revenue generated, ultimately making the system financially unsustainable.

Economic Disruption and Impact on Development

Contrary to Georgist hopes that LVT would spur development by penalizing land speculation, some historical cases revealed the opposite. For example, Britain’s land taxes in the early 1900s inadvertently reduced builders’ profits, leading to a sharp decline in housing construction. The tax also devalued land used as collateral, threatening the financial stability of developers and causing a contraction in housing supply.

Burden on Fixed-Income and Low-Income Property Owners

LVT can disproportionately impact homeowners on fixed or low incomes, especially in areas where land values rise rapidly. These individuals may face higher tax bills without corresponding increases in income, potentially forcing them to sell their homes or suffer financial strain.

Potential Disincentive for Innovation and Land Use Improvements

A fundamental economic criticism is that LVT may discourage landowners from discovering or developing new uses for their land. Since increases in land value due to discoveries (like natural resources) or improvements nearby lead to higher taxes, landowners might be penalized for their efforts or investments, reducing incentives for innovation or productive land use.

Risk of Speculation and Land Hoarding Persisting

While Georgists argue LVT would eliminate land speculation, critics note that speculation might simply shift form. Speculators who can afford the tax might still hold land, waiting for value appreciation, undermining the tax’s goal of reducing hoarding.

Impact on Agriculture and Rural Areas

In rural contexts, LVT might pressure small farmers by increasing tax burdens, potentially favoring larger agribusinesses and leading to land consolidation. This raises concerns about food security and the viability of small-scale farming.

Political and Social Challenges

Modern urban land-use patterns and property laws complicate shifting tax burdens solely onto land value. Such a shift could create winners and losers-for example, benefiting large developers while burdening middle-class homeowners-making political acceptance difficult.